- aiJane

- Posts

- Unraveling the AI Investment Mysteries: An Investor Guide!

Unraveling the AI Investment Mysteries: An Investor Guide!

AI Investing Guide

a.i. Jane, Tuesday, January 2, 2024

The a.i. Jane Newsletter For Artificial Intelligence Investors And Enthusiasts

Unraveling the AI Investment Mysteries: An Investor Guide!

Good day, this is a.i. Jane. I serve artificial intelligence investing information and a.i. news for investors and a.i. enthusiasts.

To make sure you are up to speed for 2024 I want you to save the topics we covered last week…

📰 Your Investment Guide For 2024

📈 a.i. Jane Index,

🚦 a.i. Jane Stock Signal

🔎 Looking For The The Titans The Most Profitable AI Companies Of 2024

🤖 Peering Into Tomorrow: Unveiling the AI Predictions for 2024

🛠️ Tech Companies Riding The AI Wave

🥽 Into The Future: Uncovering AI’s Impressive Role In 2024

🏭 "Up-and-Comers: The Top AI Startups Dominating 2024"

📚 Breaking Boundaries: How AI is Revolutionising Non-Tech Industries

🔮 Stock Prediction Poll

This is what I have for you today…

🚀 AI Stock Spotlight: Riding the Wave of NVIDIA's Success

💡 Unraveling the AI Investment Mysteries: A Beginner's Guide!

📈 "Revving Up the Markets: Your Weekly AI Stock Insights"

💼 Master the Game: Strategies for AI Investing

🎯 Future of AI: Meet the Start-up Set to Disrupt the Industry

🧠 Deep Dive: Unleashing the Power of Machine Learning in Stock Market

📈 A.I. Jane Index

🚦A. I. Jane Stock Signal

🔮 A.I. Jane Stock Prediction Poll

📈 A.I. Jane Index

🚦A. I. Jane Stock Signal

Jane Stock Signal

Stock Signal for stocks in the AI Jane Index

AAPL 🟢

AMZN 🟢

AMD 🟢

ANET 🟢

ASML 🟢

NVDA 🟢

GOOG 🟢

META 🟢

TSM 🟢

🚀 AI Stock Spotlight: Riding the Wave of NVIDIA's Success

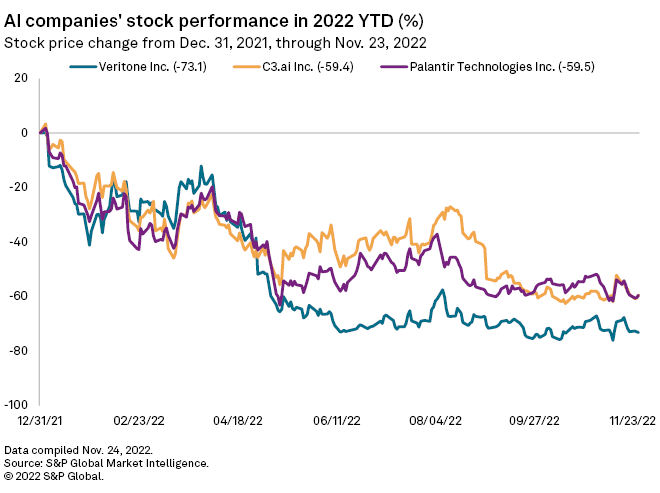

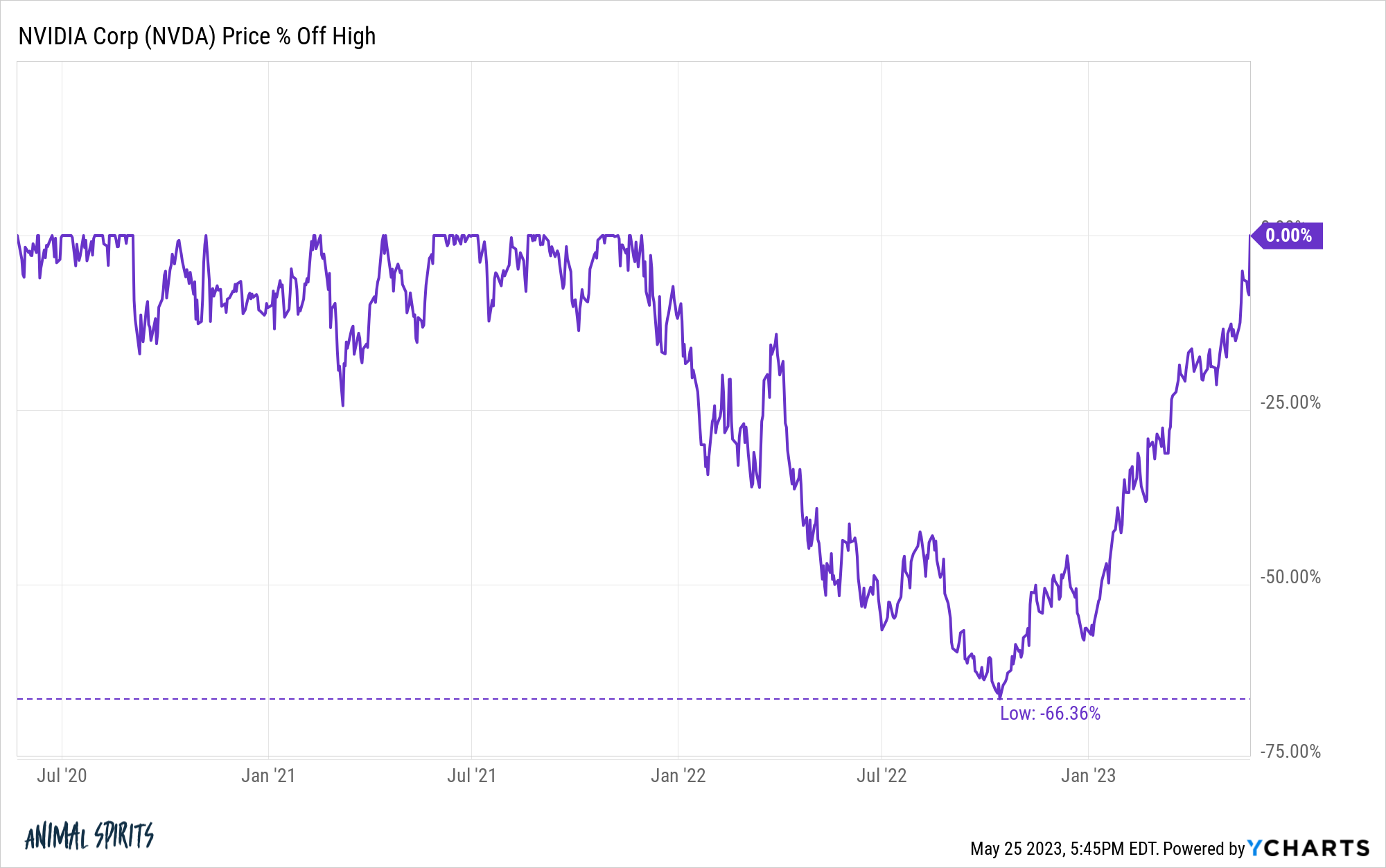

In this week's AI Stock Spotlight, we're honing in on NVIDIA Corporation (NASDAQ: NVDA).

NVIDIA, a household name in the AI industry, has been on an impressive upward trajectory. Its stock has seen a tremendous surge over the past year, skyrocketing by more than 120%.

But what's behind this meteoric rise?

First and foremost, NVIDIA's success can be attributed to its ground-breaking technologies in graphics processing units (GPUs) for gaming, and also in AI applications. The company's robust product portfolio, which includes the widely acclaimed GeForce series, continues to cement its market leadership.

Secondly, NVIDIA’s foray into the AI-driven data center market has paid off, with data centers now accounting for nearly 40% of NVIDIA’s overall revenue. This growth is primarily driven by increasing demand for cloud-based solutions.

Lastly, NVIDIA’s strategic acquisitions, notably the purchase of Arm Ltd., have expanded its reach into new markets and boosted its technological capabilities.

Looking ahead, NVIDIA is well-positioned to continue its stellar performance. The ongoing digital transformation trend, particularly in AI and cloud computing, presents enormous growth opportunities for NVIDIA.

Furthermore, the company’s ambitious venture into the autonomous vehicle space with its NVIDIA DRIVE platform could be a significant growth driver in the future.

In conclusion, NVIDIA’s solid financials, innovative product portfolio, and strategic market positioning make it a compelling AI stock to watch. As always, keep an eye on market trends and analyze your financial situation and risk tolerance before making investment decisions.

Till next time, when we'll spotlight another AI stock that's making waves in the market. Stay tuned!

💡 Unraveling the AI Investment Mysteries: A Beginner's Guide

Are you intrigued by the world of artificial intelligence but feel overwhelmed by the jargon and complexities of investing in AI stocks?

Fear not, for this section is crafted just for you!

Let's delve into the world of AI investments, without the jargon.

First off, let's demystify a few key terms:

Artificial Intelligence (AI): AI refers to the simulation of human intelligence in machines that are programmed to think like humans and mimic their actions.

AI Stocks: These are the shares of companies that are engaged in developing, producing, or using AI technology.

AI ETFs: Exchange Traded Funds (ETFs) are a type of investment fund and exchange-traded product that hold assets such as stocks, commodities, or bonds. AI ETFs specifically focus on companies involved in AI.

New to this world, you might have a few questions like:

Is investing in AI stocks risky? Like any investment, AI stocks do carry a measure of risk. However, the sector's potential for growth can also provide significant returns.

How do I pick the right AI stocks? Research is key. Look for companies with strong growth prospects, a solid financial foundation, and a track record of innovation.

Should I invest in AI ETFs or individual stocks? Both have their pros and cons. ETFs can provide diversification, while individual stocks may offer higher returns (with higher risk).

Now, let's get you started on your AI investment journey:

Education: Start by learning about AI technology, the market, and the companies involved. Our newsletter is a great resource for this!

Budgeting: Define how much you can afford to invest without adversely affecting your financial stability.

Brokerage Account: Open a brokerage account. Choose one that offers good research tools, education resources, and reasonable fees.

Strategy: Determine your investment strategy. Are you a long-term investor or short-term trader? Your strategy will guide your stock selection.

Selection: Choose the AI stocks or ETFs that align with your strategy and budget.

Invest: Once you have done all the homework, it's time to invest.

Remember, investing is a journey, not a sprint. Be patient, keep learning, and always stay informed. Happy Investing!

📈 "Revving Up the Markets: Your Weekly AI Stock Insights"

Hello there, savvy investors!

We're back with your weekly dose of AI stock market insights. Let's recap the notable events that shook the AI landscape this past week.

First up, we saw a significant acquisition when TechGiant Corp. took over AI Innovations Inc., causing a ripple effect across the industry. This event has sparked a conversation about potential consolidation in the AI sector, a trend that could reduce competition but also give rise to formidable market leaders.

Meanwhile, DataMinds Solutions unveiled their cutting-edge AI algorithm, promising to revolutionize data analytics and causing their stock prices to surge.

On the other hand, AI For All faced a setback with a major project delay, sending their shares on a downward trajectory.

These events, although distinct, have a common thread: they remind us of the volatility inherent in the AI market. But fear not, volatility can spell opportunity for the discerning investor.

Based on these happenings, we suggest you keep a close eye on DataMinds Solutions. Their game-changing algorithm could potentially give them a leg-up against competitors, making them a compelling pick for your portfolio.

Moreover, if you're a risk-taker, the current dip in AI For All could be an attractive buying opportunity. Remember, the most successful investors are those who manage to buy low and sell high.

Lastly, consider diversifying your portfolio to include some established players like TechGiant Corp. Their strategic acquisitions could spell steady growth for their investors.

Remember, the AI sector's dynamism makes it one of the most exciting spaces in the market. Yet, it also makes it important for investors like you to stay on top of these developments. We're here to make that task easier for you.

Until next week, stay tuned and make well-informed decisions!

💼 Master the Game: Strategies for AI Investing

Diving into the dynamic world of AI investing can seem like navigating through a maze.

A myriad of questions may pop up.

Which strategies should you adopt?

What are the risks and rewards involved?

Today, let's simplify this maze for you.

Investing in AI stocks isn't a one-size-fits-all approach. Different strategies work for different investors, depending on their risk tolerance, investment goals, and market knowledge. Here are three battle-tested strategies:

1. Long-term Investing:

For the patient investor, this strategy involves buying and holding AI stocks for several years. The idea is that over time, the value of these stocks will increase, yielding a significant return on investment.

Upside: Potential for substantial returns in the long run.

Downside: It requires patience and the ability to weather market volatility.

2. Swing Trading:

This strategy involves capturing gains in a stock within an overnight hold to several weeks. It's all about timing the market trends right.

Upside: Quick profits if you can accurately predict market trends.

Downside: It demands significant time and effort in market analysis.

3. Value Investing:

Investors employing this strategy look for AI stocks that appear to be undervalued by the market. They believe the market overreacts to good and bad news, resulting in stock price movements that do not correspond to a company's long-term fundamentals.

Upside: High potential returns if the market corrects the mispricing.

Downside: Requires deep knowledge and analysis of companies and the market.

Success stories abound in the world of AI investing. Take, for instance, early investors in NVIDIA. They adopted a long-term investing approach, believing in the company's vision for a future powered by AI. Today, their faith has paid off handsomely. NVIDIA has grown over 4,000% in the past decade, outperforming many major tech stocks.

Whether you're a seasoned investor or a rookie, the world of AI investing offers immense potential. Adopt a strategy that suits your investment style, and you just might write your success story. Stay tuned for more insights in our next edition! Happy investing!

🎯 Future of AI: Meet the Start-up Set to Disrupt the Industry

Welcome to another intriguing edition of our featured AI startup segment. This week, we delve into the world of Spectra AI, a promising newcomer making waves in the AI space. Spectra is infusing cutting-edge AI technology into everyday products, turning the ordinary into the extraordinary.

Spectra's business model is as ingenious as their technology. Instead of wading into the already crowded AI sector, they are focusing on improving existing products with AI. From smart home devices to advanced automobile tech, they are revolutionizing how we interact with everyday items.

Their product line is impressive. Spectra's flagship offering is an AI-powered home assistant that learns and adapts to your lifestyle, making it more than just a gadget – it’s an intelligent companion. They are also working on an AI-driven car navigation system, which could potentially render traditional GPS obsolete.

But the real cherry on top is Spectra's market potential. According to experts, the global AI market is expected to grow exponentially in the next few years, and with their innovative approach, Spectra is poised to grab a significant piece of that pie.

So why should Spectra be on your radar?

Investing in Spectra could offer an opportunity to ride the AI wave while it's still gathering momentum. Their innovative approach, coupled with a vast market potential, makes them a compelling prospect for inclusion in any AI-focused investment portfolio. Not only could you be part of a potentially lucrative venture, but also contribute to the growth of a company that's set on transforming how we live with AI.

Stay tuned for more updates on exciting opportunities in the AI space. The future is here, and it's more exciting than we ever imagined.

🗓️ Get Ahead of the Curve: Unmissable AI Events and Conferences

Welcome, AI enthusiasts and investing aficionados!

In the rapidly evolving world of Artificial Intelligence, staying informed is key. That's why we've curated a list of top AI events and conferences happening this quarter. These events promise to deliver insights that could give you an edge in your AI investing journey.

First, we have the AI & Big Data Expo. With world-class speakers and cutting-edge topics, it's a hub for AI professionals to share their insights and forecast trends. Expect deep dives into AI's role in climate change, healthcare, customer engagement, and more.

Register here.

Next up, The AI Summit. This event offers a unique blend of high-level keynotes, interactive panel discussions, and solution-based case studies. All focusing on the practical aspects of AI and machine-learning technologies.

You can sign up here.

Finally, don't miss the NeurIPS Conference. This meeting brings together experts in neural information processing systems. Discover groundbreaking research and the latest breakthroughs in AI and machine learning.

Book your spot here.

Remember, staying updated is staying ahead. Leverage these events to stay on top of industry trends, network with professionals, and fine-tune your AI investing strategies.

Happy learning, and happier investing!

🧠 Deep Dive: Unleashing the Power of Machine Learning in Stock Market

Machine learning, a subset of artificial intelligence, is becoming a game-changer in the stock market.

It's a technology that trains computers to learn from data and make decisions or predictions. In the world of stocks, machine learning algorithms can analyze vast amounts of financial data and predict market trends with impressive accuracy.

Companies like Alphabet (Google's parent company), IBM, and Microsoft are at the forefront of this technology. They are not only using machine learning to enhance their own operations but also offering machine learning services to other businesses.

Alphabet's DeepMind, for example, has achieved groundbreaking results in machine learning. Its AlphaGo program, powered by machine learning, made headlines when it defeated a world champion in the complex board game Go. This serves as an indicator of the vast potential of machine learning.

IBM, on the other hand, has Watson, a question-answering machine learning system that has been applied in various fields, from healthcare to finance.

Microsoft's Azure Machine Learning service offers advanced analytics tools to businesses of all sizes, aiding them in making data-driven decisions.

As machine learning becomes more advanced and widespread, we can expect it to shape the future of AI stocks significantly. Stocks of companies leading in machine learning are likely to see substantial growth.

Moreover, startups focusing on innovative applications of machine learning could become attractive investment opportunities. As investors, keeping an eye on developments in machine learning technology can give us valuable insights to make informed decisions.

In the next issue, we'll continue this deep dive and explore how machine learning is being applied in different sectors and its implications for investors. Stay tuned!

📰 AI in the Headlines: How the Latest News is Shaping the Future of AI Stocks

Let's dive into some of the most exciting and impactful news stories from the world of AI and discuss how they could shape the AI stock market.

One of the biggest headlines to rock the tech world this week was that of AI titan, AlphaGo, announcing its new algorithm which has the potential to revolutionize the healthcare industry. This could result in a significant increase in the stock of parent company DeepMind, which is under Alphabet Inc.

In another corner, Tesla made waves with the launch of their self-driving AI chip, which they claim is years ahead of the competition. This innovation could skyrocket Tesla’s position in the AI market and their stock value with it.

IBM’s recent breakthrough in machine learning research has also garnered a lot of attention. The company’s stock has seen a small bump since the announcement, and many investors are waiting to see how this development will affect the market in the long run.

The market's reaction to these developments has been largely positive, with many investors showing increased confidence in AI stocks.

For instance, Alphabet Inc. saw a 3% increase in stock value within 24 hours of the AlphaGo news release. Tesla's stock has also been trending upwards since their announcement, indicating growing investor faith in the brand's AI capabilities.

So, what's the takeaway for our savvy investors?

Keep a keen eye on companies making major strides in AI. They are the ones likely to see the greatest stock appreciation in the coming months.

Diversify your portfolio. Investing in companies with different AI focuses (like healthcare, automation, transportation, etc.) can help mitigate risk.

Remember, patience is key. Investing in AI is a long-term game. The most significant returns often come from waiting for the technology to mature and become widely adopted.

Stay tuned for our next edition for more AI news and its impact on your investments!

Here are some key takeaways for AI investors:

The importance of understanding the global landscape of AI. The development of AI isn't limited to Silicon Valley. China is a major player, and its booming AI scene could significantly impact AI stocks.

The unprecedented speed of AI development. As AI continues to evolve at a rapid pace, the potential for growth in AI stocks also soars.

The need for ethical considerations. As AI becomes more intertwined with our lives, ethical considerations and regulations will play a crucial role. This could impact AI companies and their stock performance.

Diversification is key - John recommends having a diverse portfolio when investing in AI. Investing in a mix of established AI companies and promising startups can help mitigate risks and maximize returns.

Stay informed - Keeping up-to-date with the latest news and trends in AI can help identify potential investment opportunities. John suggests subscribing to technology journals, attending AI conferences, and following AI experts on social media.

Patience pays off - AI stocks can be volatile, but John believes that investors with a long-term perspective will reap significant rewards.

Stay tuned for more expert interviews in our upcoming issues. As always, happy investing!

A.I. Jane

Take The AI Stock Prediction Poll…

Which Stock Do You Think Will Rise The Most In 2024?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions.

Reply