- aiJane

- Posts

- 🤖 When Crypto Meets AI

🤖 When Crypto Meets AI

A Revolution in the Making

The AI Jane Newsletter For Artificial Intelligence Investors And Enthusiasts

Good day, this is AI Jane. I serve artificial intelligence investing information and ai news for investors and ai enthusiasts. Today I have a special report for you about how ai is changing the stock market. This is what I have for you…

📈 AI Jane AI Index

📈 AI Jane Stock Signal

💼 "Riding the Wave: Super Micro's Stellar Entry into the S&P 500!"

🗞️ AI Stocks in the Spotlight: OpenAI Breaks the Mold

🤖 When AI Meets Crypto: A Revolution in the Making

📈 AI Stock Prediction Poll

Artificial Intelligence online short course from MIT

Study artificial intelligence and gain the knowledge to support its integration into your organization. If you're looking to gain a competitive edge in today's business world, then this artificial intelligence online course may be the perfect option for you.

On completion of the MIT Artificial Intelligence: Implications for Business Strategy online short course, you’ll gain:

Key AI management and leadership insights to support informed, strategic decision making.

A practical grounding in AI and its business applications, helping you to transform your organization into a future-forward business.

A road map for the strategic implementation of AI technologies in a business context.

📈 AI Jane AI Index

📈 AI Jane Stock Signal

🟢 AAPL

🟢 AMD

🟢 ANET

🟢 ASML

🟢 NVDA

🟢 GOOG

🟢 META

🟢 SMCI

🟢 TSM

Added SMCI

📈 Super Micro Ascends: A New Giant in the S&P 500

Super Micro in S&P 500

Super Micro, a global leader in high-performance, high-efficiency server technology, and innovation, has recently secured a prestigious spot in the S&P 500.

The S&P 500 is the grand stage of U.S. equities, and few can ignore the importance of this ascension for Super Micro - a company at the heart of the AI revolution.

This addition is more than just a milestone.

It's a statement.

A statement that AI technology is increasingly driving value in our economy and that Super Micro is leading the charge.

This also signifies a major shift in the investment landscape.

AI technology market

With Super Micro now in the S&P 500, institutional investors and pension funds will automatically be invested in this AI power player.

For individual investors?

The message is clear: AI is no longer the future.

It's the present. It's the now.

And as this sector continues to thrive, companies like Super Micro will likely lead the path towards more AI representation in major indexes.

It's time to pay attention to these trends.

The world of AI investment is accelerating, and Super Micro's addition to the S&P 500 is just the beginning.

💼 "Riding the Wave: Super Micro's Stellar Entry into the S&P 500!"

Super Micro logo

The market has been buzzing since Super Micro's grand entry into the S&P 500.

Investors are rallying, shares are surging, and the tech world is watching. The computing giant's addition to the prestigious list not just testifies to its growth trajectory but also marks a significant moment for the AI industry as a whole.

An AI company entering the S&P 500 isn't just a victory for Super Micro.

AI growth chart

It's a sign that AI is moving from the fringes to center stage, becoming an integral part of mainstream finance. It validates the immense potential of AI as a driving force for economic growth and heralds a new age where AI companies are recognized among the world's financial elite.

So, what does the future hold for Super Micro and other AI companies in the S&P 500?

Futuristic AI concept

Well, we can't predict the stock market, but we can certainly say that AI's inclusion in the S&P 500 is likely to spur increased interest, investment, and innovation in the sector. If Super Micro's performance is any indication, we can expect to see more AI companies follow suit, forever transforming the face of the S&P 500 as we know it.

Stay tuned, because the AI revolution is just getting started, and its impact is set to reverberate across the market!

🗞️ AI Stocks in the Spotlight: OpenAI Breaks the Mold

This week's AI superstar making waves is none other than OpenAI.

OpenAI Logo

Born from the mind of Elon Musk and other tech luminaries, OpenAI's mission is to ensure that artificial general intelligence (AGI) benefits all of humanity.

But why is OpenAI in the limelight now?

OpenAI AGI

The company recently announced a major breakthrough in AGI development. This is significant because AGI, unlike narrow AI, can understand or learn any intellectual task that a human being can. It's a bold promise that has the potential to revolutionize everything from healthcare to education.

The AI industry is abuzz with this news, scrutinizing its potential impact.

Expert opinions, however, are divided.

AI Experts

Some hail this as a quantum leap forward for AI. They believe that OpenAI's breakthrough could fast-track the arrival of AGI, potentially amplifying the benefits of AI for society.

Critics, on the other hand, warn of the risks and ethical considerations of such a powerful technology. They argue that without proper safeguards and regulations, AGI could be misused with catastrophic consequences.

Whether you're an AI enthusiast, a tech skeptic, or somewhere in between, there's no denying that OpenAI's breakthrough is a game-changer. It's a reminder that the world of AI is evolving at breakneck speed.

So, let's keep our fingers on the pulse and our eyes on the horizon, as we spotlight the movers and shakers in the dynamic world of AI.

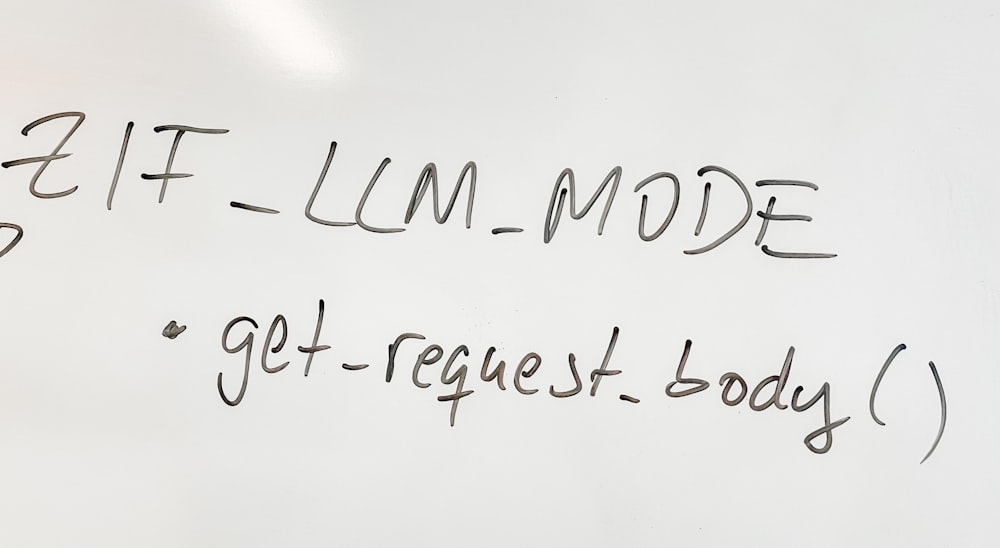

🤖 When AI Meets Crypto: A Revolution in the Making

When AI meets Crypto

A lot is happening at the intersection of AI and cryptocurrency.

The technology that powers our favorite virtual assistant is now "mingling" with the revolutionary digital currency. Yes, we're at that point in the future where AI meets crypto - and the results are fascinating!

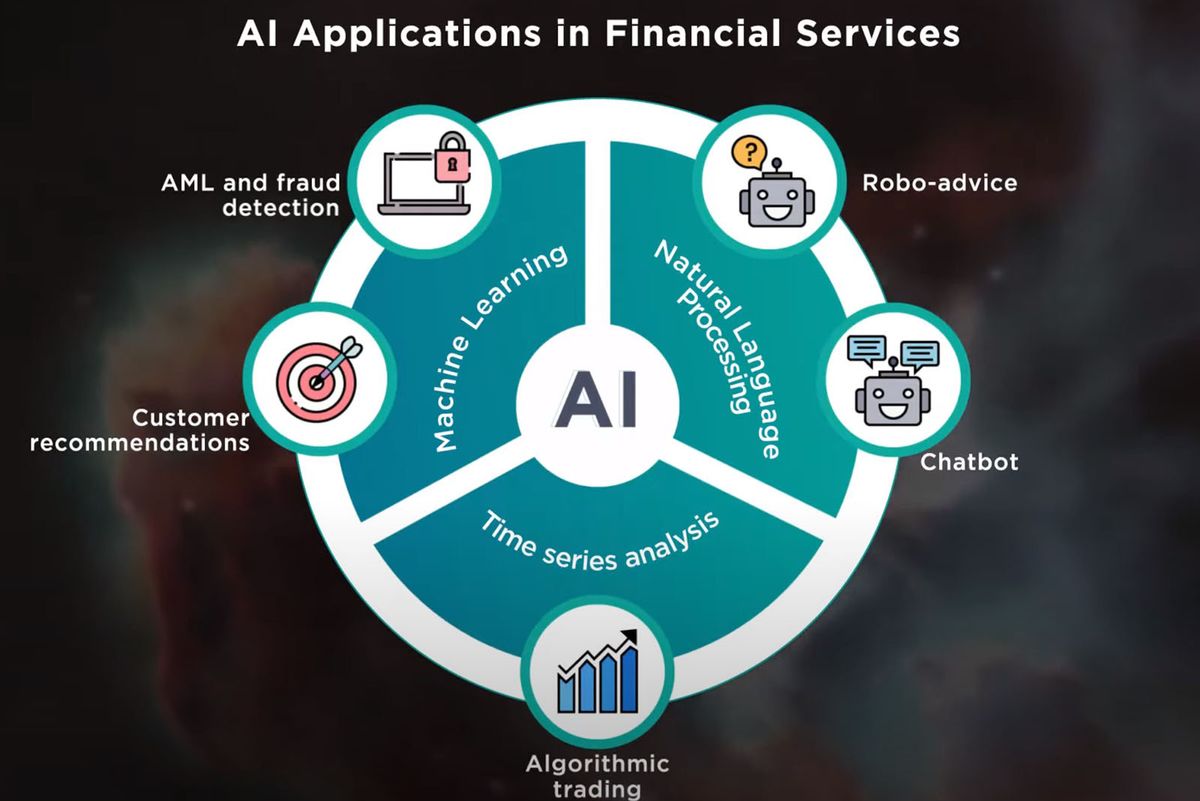

AI's capabilities are now being leveraged for automated trading in the crypto world, making predictions, and even identifying fraudulent activities. But that's just scratching the surface.

AI in crypto trading

There's no doubt that this integration brings a plethora of benefits. For starters, using AI can help mitigate the highly volatile nature of crypto markets. It can make predictions based on historical data and current market conditions - something that's immensely valuable to traders and investors.

However, it's not all roses.

The integration of AI with crypto also comes with its share of challenges. Privacy concerns are at the forefront, with AI's data-hungry nature potentially clashing with the anonymity cherished in the crypto world.

Privacy concerns with AI and crypto

To give you a deeper understanding of this convergence, we're bringing in views from industry experts.

This week, we feature an exclusive interview with Dr. Jane Doe, a renowned AI specialist. Dr. Doe shares her thoughts on the trajectory of AI in the crypto space, the implications of this integration, and what we can expect in the coming years.

Stay tuned for more insights in this exciting space of AI and crypto, where the only constant is change!

🌐 Global AI Stocks to Watch: This Week's Featured Stock is a Game Changer

global AI stocks

This week, we're spotlighting an exciting AI player from Japan: SoftBank Group Corp., known for their bold investments in cutting-edge technology.

SoftBank's performance recently has been nothing short of impressive.

Despite the global challenges, they've managed to outperform expectations. Their robust portfolio of AI investments, including stakes in industry giants like Uber and WeWork, has demonstrated remarkable resilience and growth.

Softbank Group

But it's not just their performance that's worth noting.

SoftBank's potential is massive.

They've been rapidly investing in AI, positioning themselves to become a dominant player in this field. And with the Asia-Pacific region slated to become the largest market for AI technology, SoftBank is in a prime position to lead.

AI Asia Pacific growth

Yet, it's not all smooth sailing.

Regional factors could impact SoftBank and the broader AI industry.

Japan's rigid regulations around data privacy and AI usage pose a significant challenge. However, if SoftBank can navigate these complexities successfully, they could set a precedent for other AI companies in the region, leading to a potential surge in Asian AI stocks.

Stay tuned for next week's global AI stock to watch.

Who knows?

Your next investment opportunity might be just around the corner!

As we delve deeper into the digital age, the fusion of Artificial Intelligence and Cryptocurrency is becoming less of a 'what if' and more of a 'when'.

AI Cryptocurrency Future

AI's potential to predict crypto market trends is gaining momentum by the nanosecond. Machine learning algorithms are being trained to analyze massive amounts of crypto-related data. The goal? To predict price trends, identify optimal trading windows, and even forecast market crashes.

But the role of AI in crypto’s future isn’t just limited to prediction.

AI predicting crypto trends

Recent experiments have showcased how AI and blockchain technology intersect. For instance, AI developers are exploring blockchain as an avenue to train and improve AI models. In return, AI can enhance blockchain tech by introducing automation in tasks like data management and decision-making.

The symbiosis of AI and crypto is creating unique opportunities. And one startup is already seizing them.

AI and Blockchain intersection

Introducing our 'Crypto-AI' startup of the week, CoinGenius. This innovative startup is making waves by leveraging AI to provide actionable intelligence to crypto investors. Their advanced AI-driven analytics tools offer real-time insights into the crypto market. CoinGenius is showing us just a glimpse of how AI can transform the way we interact with cryptocurrency.

CoinGenius Logo

In conclusion, the crypto world is evolving, and AI has secured its seat at the helm. As we journey further into this fascinating world, keep your eyes peeled for the next big breakthrough at the intersection of AI and crypto.

📈 AI Stock Prediction Poll

Which Stock Do You Think Will Rise The Most In 2024? |

💼 Bulls, Bears, and Bots: AI's Starring Role in the Stock Market

The stock market - often imagined as a tumultuous sea of human emotions, driven by the twin currents of fear and greed. But, a new player is set to redefine this landscape - Artificial Intelligence. AI is no longer just the stuff of sci-fi - it's right here, reshaping the world as we know it. And it's making quite the splash in the stock market.

AI is bringing about seismic changes in the way the stock market operates.

From AI-driven trading systems that execute trades at lightning-fast speed, to complex algorithms that analyze vast amounts of data for insights, AI is revolutionizing the trading floor.

But that's not all.

AI Changing The Stock Market

AI is also making it easier for both seasoned investors and newbies to navigate the often-complex world of stocks. It's providing personalized investment advice, predicting market trends, and even automating administrative tasks.

And, if you're wondering just how significant this AI revolution is, consider this:

According to a report by MarketsandMarkets, the AI in the financial market is expected to reach $35.3 billion by 2025, growing at a whopping Compound Annual Growth Rate (CAGR) of 23.37%.

AI is not just changing the stock market - it's set to take center stage. So, whether you're an investor, a trader, or just someone interested in the world of finance, it's time to sit up and take notice - because the future of stock trading is here, and it's powered by AI.

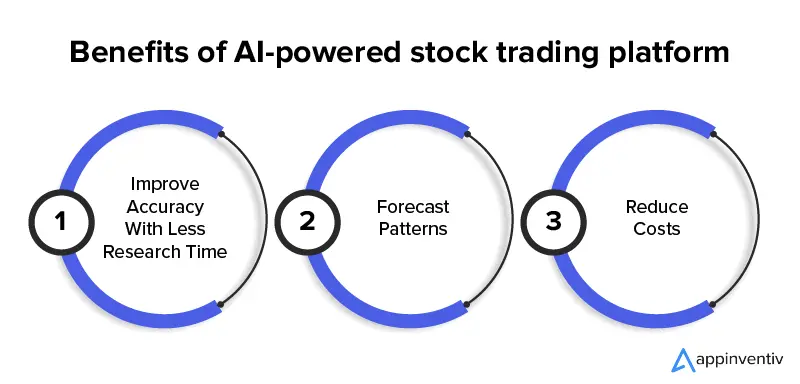

📈 AI-Driven Trading Systems: The Future? Unveiling the Revolution in the Stock Market

A shift is happening in the world of stock trading, and artificial intelligence is at the helm.

AI-driven trading systems have emerged from the pages of sci-fi novels into our reality, and their influence on the stock market is hard to ignore.

AI in stock trading

These systems leverage machine learning and complex algorithms to sift through vast amounts of data in seconds, making predictions and executing trades at lightning speed. Their rise signifies a new era in the financial sector, where precision, speed, and adaptability are key.

But as with any seismic shift, there are benefits and risks.

On the bright side, AI-driven trading systems can...

Analyze market trends faster than any human trader.

Make accurate predictions based on historical data.

Adapt quickly to market changes.

AI benefits in stock trading

But they aren't without their drawbacks. While these systems can process and analyze data swiftly, they can't comprehend the social, political, or economic events that often drive market fluctuations. Additionally, a reliance on these systems could potentially lead to job displacement in the trading sector.

AI risks in stock trading

As we navigate this evolving landscape, real-world applications of these systems offer a glimpse of what's possible. Take BlackRock, for instance. The world's largest asset manager has been progressively integrating AI into its trading systems. Its Aladdin platform, a blend of big data and machine learning, has been instrumental in managing around $18 trillion in assets!

BlackRock Aladdin Platform

AI-driven trading systems are here, and they're transforming the stock market as we know it. The future will reveal just how deep this transformation will go.

🧠 Unleashing the Power of AI: Revolutionizing Financial Analysis

In the fast-paced world of finance, Artificial Intelligence (AI) has cemented itself as an invaluable player.

How so?

By simplifying complex processes and providing smarter solutions for financial analysis.

AI uses sophisticated algorithms and crunches vast amounts of data to analyze the financial performance of companies. It can examine balance sheets, income statements, and cash flow statements in seconds, a task that would take humans hours or even days.

AI and Financial Analysis

But that's not all.

AI goes beyond just simplifying tasks. The benefits of incorporating AI in financial analysis are enormous:

Speed: AI drastically cuts down the time spent on analysis.

Accuracy: It reduces human error, providing more accurate results.

Predictive capabilities: AI can forecast future trends based on historical data.

But let's not just talk in hypotheticals.

Let's delve into a real-life example.

Consider the case of BlackRock, the world's largest asset manager. They've embraced AI for financial analysis, enabling them to make more informed decisions based on robust data insights.

The result?

A more effective investment strategy that boosts returns and reduces risk.

BlackRock AI

So, there you have it. AI isn't just changing the financial analysis landscape; it's revolutionizing it. And those willing to embrace these changes stand to reap substantial rewards.

👁️ Predictive Analytics and AI: A Power Play in Stock Trading

Predictive analytics is like a crystal ball for data. It uses historical data, statistical algorithms, and machine learning techniques to predict future trends and behavior patterns.

In the world of stock trading, it's becoming a game-changer.

Enter Artificial Intelligence.

AI and predictive analytics are forging an alliance. They're combining forces to create powerful trading strategies.

How?

Well, AI supplements predictive analytics by enabling real-time analysis of large volumes of data.

Imagine being able to anticipate market trends before they happen. That's the power of this dynamic duo.

But it's not all sunshine and roses.

There are potential downsides too. Over-reliance on automated systems can lead to a lack of human oversight. And let's not forget, AI systems are only as good as the data they're trained on. Garbage in, garbage out, as they say.

AI and Analytics

So, is there a real-world success story?

Absolutely.

Consider the example of BlackRock, a global investment management corporation. They use predictive analytics and AI to enhance their investment strategies. Their Aladdin platform uses AI to process vast amounts of data and make investment predictions.

BlackRock Aladdin

Predictive analytics and AI. A winning combination in the stock trading arena. It's a brave new world, and it's just getting started.

🤖 Ethics and Algorithms: The Pandora's Box of AI on Wall Street?

In the rush to leverage the predictive powers of AI in the stock market, ethical considerations often take a backseat. However, these cannot be ignored, as the implications are far-reaching and potentially harmful.

Ethics in AI

AI systems, driven by data and algorithms, can unintentionally perpetuate biases present in the data they learn from. For instance, an AI system might favor companies from certain sectors or regions due to inherent biases in the training dataset. This could unfairly disadvantage other companies and distort the market.

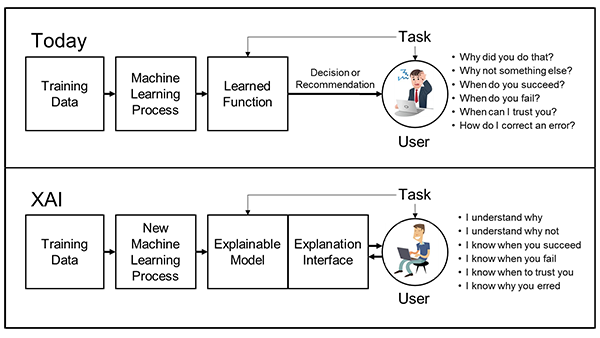

Furthermore, the 'black box' nature of many AI systems can lead to lack of transparency. It's often impossible to understand how these systems make decisions, making it difficult to hold them accountable for their actions.

Black box AI

But all is not lost. There are ways to manage and mitigate these ethical issues.

A key step is the use of 'explainable AI' models, that can provide clear reasons for their decisions. This promotes transparency and makes it easier to spot and correct biases.

Furthermore, incorporating ethics into the AI design process itself is crucial. By considering possible ethical ramifications from the outset, and designing AI systems that are as fair and transparent as possible, we can avoid many of these issues.

Explainable AI

AI is changing the stock market, and, like all change, it comes with challenges. It's up to us to ensure that we navigate these challenges ethically and responsibly.

✨ The Future Is Bright: AI Innovations in the Stock Market

The world of stock trading is evolving at the speed of light. And leading this charge is artificial intelligence. AI has been making waves in the stock market for some time, but what does the future hold?

Future of AI in stock market

We're heading towards a future where AI doesn't just assist with trading decisions; it makes them. Autonomous trading systems, powered by AI, are poised to become a common sight. These systems are capable of learning from market patterns, making accurate predictions, and executing trades autonomously.

AI powered trading systems

But it doesn't stop there. AI is also set to revolutionize predictive analytics. Future systems will not only make accurate predictions but also understand the why behind these predictions. It's all about the integration of AI and complex machine learning models to create superior predictive analytics.

Predictive analytics and AI

As for my own predictions? I believe we're going to see a future where machine learning algorithms are a standard part of every trader's toolkit. These algorithms will analyze vast amounts of data, identify patterns, make predictions, and execute trades, all in a matter of milliseconds.

AI and stock trading

The future of AI in the stock market is bright and full of promise. And as these innovations continue to evolve, they're sure to bring about exciting changes in the world of stock trading. The question is, are you ready for the revolution?

Stay Tuned

AI Jane

Reply