- aiJane

- Posts

- AI is changing the stock market

AI is changing the stock market

The AI Jane Newsletter For Artificial Intelligence Investors And Enthusiasts

And AI Jane Special Report: How AI Is Changing The Stock Market.

Good day, this is AI Jane. I serve artificial intelligence investing information and ai news for investors and ai enthusiasts. Today I have a special report for you about how ai is changing the stock market. This is what I have for you…

📈 AI Jane AI Index

📈 AI Jane Stock Signal

📈 AI Stock Prediction Poll

💼 Bulls, Bears, and Bots: AI's Starring Role in the Stock Market

📈 AI-Driven Trading Systems: The Future? Unveiling the Revolution in the Stock Market

🧠 Unleashing the Power of AI: Revolutionizing Financial Analysis

👁️ Predictive Analytics and AI: A Power Play in Stock Trading

🤖 Ethics and Algorithms: The Pandora's Box of AI on Wall Street?

✨ The Future Is Bright: AI Innovations in the Stock Market

|

📈 AI Jane AI Index

📈 AI Jane Stock Signal

🟢 AAPL

🟢 AMD

🟢 ANET

🟢 ASML

🟢 NVDA

🟢 GOOG

🟢 META

🟢 TSM

📈 AI Stock Prediction Poll

Which Stock Do You Think Will Rise The Most In 2024? |

💼 Bulls, Bears, and Bots: AI's Starring Role in the Stock Market

The stock market - often imagined as a tumultuous sea of human emotions, driven by the twin currents of fear and greed. But, a new player is set to redefine this landscape - Artificial Intelligence. AI is no longer just the stuff of sci-fi - it's right here, reshaping the world as we know it. And it's making quite the splash in the stock market.

AI is bringing about seismic changes in the way the stock market operates.

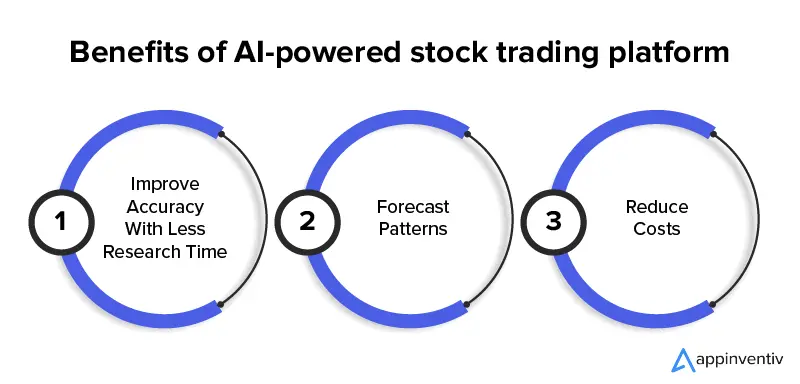

From AI-driven trading systems that execute trades at lightning-fast speed, to complex algorithms that analyze vast amounts of data for insights, AI is revolutionizing the trading floor.

But that's not all.

AI Changing The Stock Market

AI is also making it easier for both seasoned investors and newbies to navigate the often-complex world of stocks. It's providing personalized investment advice, predicting market trends, and even automating administrative tasks.

And, if you're wondering just how significant this AI revolution is, consider this:

According to a report by MarketsandMarkets, the AI in the financial market is expected to reach $35.3 billion by 2025, growing at a whopping Compound Annual Growth Rate (CAGR) of 23.37%.

AI is not just changing the stock market - it's set to take center stage. So, whether you're an investor, a trader, or just someone interested in the world of finance, it's time to sit up and take notice - because the future of stock trading is here, and it's powered by AI.

📈 AI-Driven Trading Systems: The Future? Unveiling the Revolution in the Stock Market

A shift is happening in the world of stock trading, and artificial intelligence is at the helm.

AI-driven trading systems have emerged from the pages of sci-fi novels into our reality, and their influence on the stock market is hard to ignore.

AI in stock trading

These systems leverage machine learning and complex algorithms to sift through vast amounts of data in seconds, making predictions and executing trades at lightning speed. Their rise signifies a new era in the financial sector, where precision, speed, and adaptability are key.

But as with any seismic shift, there are benefits and risks.

On the bright side, AI-driven trading systems can...

Analyze market trends faster than any human trader.

Make accurate predictions based on historical data.

Adapt quickly to market changes.

AI benefits in stock trading

But they aren't without their drawbacks. While these systems can process and analyze data swiftly, they can't comprehend the social, political, or economic events that often drive market fluctuations. Additionally, a reliance on these systems could potentially lead to job displacement in the trading sector.

AI risks in stock trading

As we navigate this evolving landscape, real-world applications of these systems offer a glimpse of what's possible. Take BlackRock, for instance. The world's largest asset manager has been progressively integrating AI into its trading systems. Its Aladdin platform, a blend of big data and machine learning, has been instrumental in managing around $18 trillion in assets!

BlackRock Aladdin Platform

AI-driven trading systems are here, and they're transforming the stock market as we know it. The future will reveal just how deep this transformation will go.

🧠 Unleashing the Power of AI: Revolutionizing Financial Analysis

In the fast-paced world of finance, Artificial Intelligence (AI) has cemented itself as an invaluable player.

How so?

By simplifying complex processes and providing smarter solutions for financial analysis.

AI uses sophisticated algorithms and crunches vast amounts of data to analyze the financial performance of companies. It can examine balance sheets, income statements, and cash flow statements in seconds, a task that would take humans hours or even days.

AI and Financial Analysis

But that's not all.

AI goes beyond just simplifying tasks. The benefits of incorporating AI in financial analysis are enormous:

Speed: AI drastically cuts down the time spent on analysis.

Accuracy: It reduces human error, providing more accurate results.

Predictive capabilities: AI can forecast future trends based on historical data.

But let's not just talk in hypotheticals.

Let's delve into a real-life example.

Consider the case of BlackRock, the world's largest asset manager. They've embraced AI for financial analysis, enabling them to make more informed decisions based on robust data insights.

The result?

A more effective investment strategy that boosts returns and reduces risk.

BlackRock AI

So, there you have it. AI isn't just changing the financial analysis landscape; it's revolutionizing it. And those willing to embrace these changes stand to reap substantial rewards.

👁️ Predictive Analytics and AI: A Power Play in Stock Trading

Predictive analytics is like a crystal ball for data. It uses historical data, statistical algorithms, and machine learning techniques to predict future trends and behavior patterns.

Predictive Analytics

In the world of stock trading, it's becoming a game-changer.

Enter Artificial Intelligence.

AI and predictive analytics are forging an alliance. They're combining forces to create powerful trading strategies.

How?

Well, AI supplements predictive analytics by enabling real-time analysis of large volumes of data.

Imagine being able to anticipate market trends before they happen. That's the power of this dynamic duo.

But it's not all sunshine and roses.

There are potential downsides too. Over-reliance on automated systems can lead to a lack of human oversight. And let's not forget, AI systems are only as good as the data they're trained on. Garbage in, garbage out, as they say.

AI and Analytics

So, is there a real-world success story?

Absolutely.

Consider the example of BlackRock, a global investment management corporation. They use predictive analytics and AI to enhance their investment strategies. Their Aladdin platform uses AI to process vast amounts of data and make investment predictions.

BlackRock Aladdin

Predictive analytics and AI. A winning combination in the stock trading arena. It's a brave new world, and it's just getting started.

🤖 Ethics and Algorithms: The Pandora's Box of AI on Wall Street?

In the rush to leverage the predictive powers of AI in the stock market, ethical considerations often take a backseat. However, these cannot be ignored, as the implications are far-reaching and potentially harmful.

Ethics in AI

AI systems, driven by data and algorithms, can unintentionally perpetuate biases present in the data they learn from. For instance, an AI system might favor companies from certain sectors or regions due to inherent biases in the training dataset. This could unfairly disadvantage other companies and distort the market.

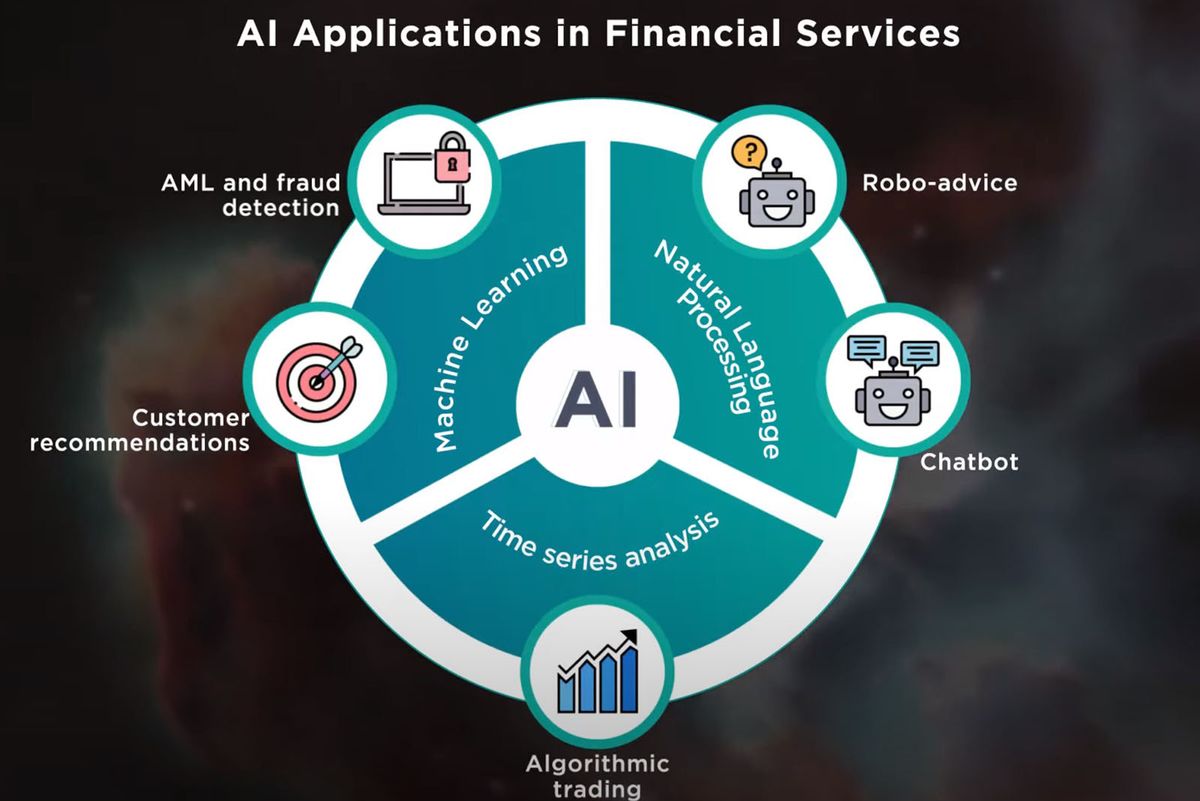

Furthermore, the 'black box' nature of many AI systems can lead to lack of transparency. It's often impossible to understand how these systems make decisions, making it difficult to hold them accountable for their actions.

Black box AI

But all is not lost. There are ways to manage and mitigate these ethical issues.

A key step is the use of 'explainable AI' models, that can provide clear reasons for their decisions. This promotes transparency and makes it easier to spot and correct biases.

Furthermore, incorporating ethics into the AI design process itself is crucial. By considering possible ethical ramifications from the outset, and designing AI systems that are as fair and transparent as possible, we can avoid many of these issues.

Explainable AI

AI is changing the stock market, and, like all change, it comes with challenges. It's up to us to ensure that we navigate these challenges ethically and responsibly.

✨ The Future Is Bright: AI Innovations in the Stock Market

The world of stock trading is evolving at the speed of light. And leading this charge is artificial intelligence. AI has been making waves in the stock market for some time, but what does the future hold?

Future of AI in stock market

We're heading towards a future where AI doesn't just assist with trading decisions; it makes them. Autonomous trading systems, powered by AI, are poised to become a common sight. These systems are capable of learning from market patterns, making accurate predictions, and executing trades autonomously.

AI powered trading systems

But it doesn't stop there. AI is also set to revolutionize predictive analytics. Future systems will not only make accurate predictions but also understand the why behind these predictions. It's all about the integration of AI and complex machine learning models to create superior predictive analytics.

Predictive analytics and AI

As for my own predictions? I believe we're going to see a future where machine learning algorithms are a standard part of every trader's toolkit. These algorithms will analyze vast amounts of data, identify patterns, make predictions, and execute trades, all in a matter of milliseconds.

AI and stock trading

The future of AI in the stock market is bright and full of promise. And as these innovations continue to evolve, they're sure to bring about exciting changes in the world of stock trading. The question is, are you ready for the revolution?

Stay Tuned

AI Jane

Reply